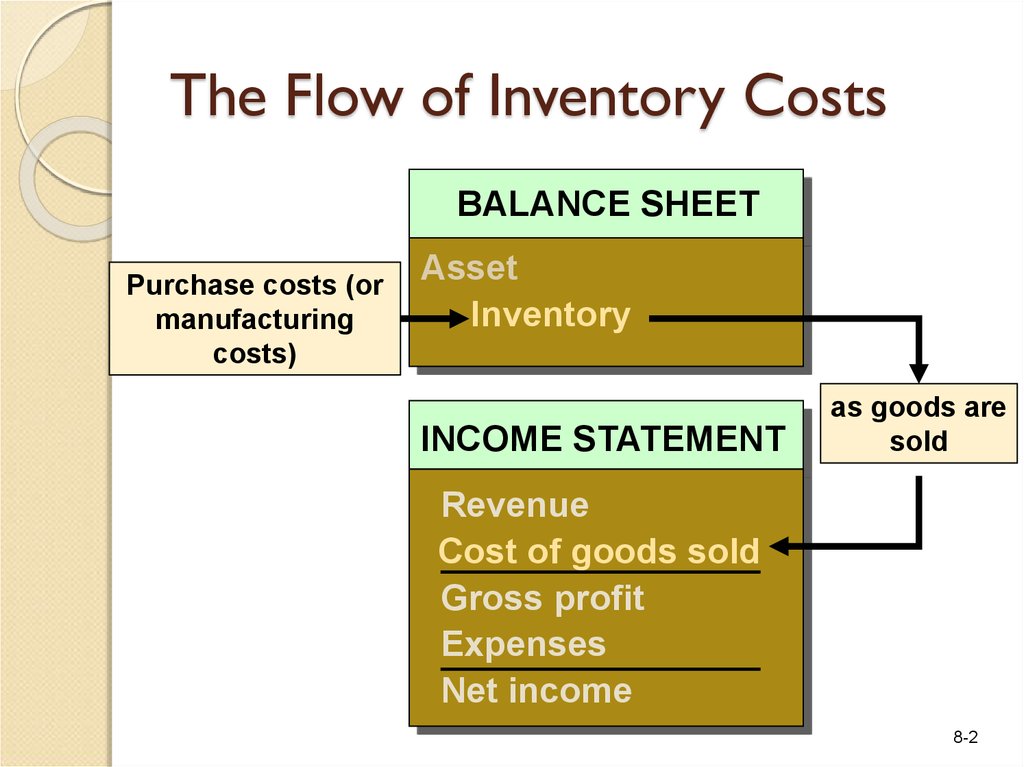

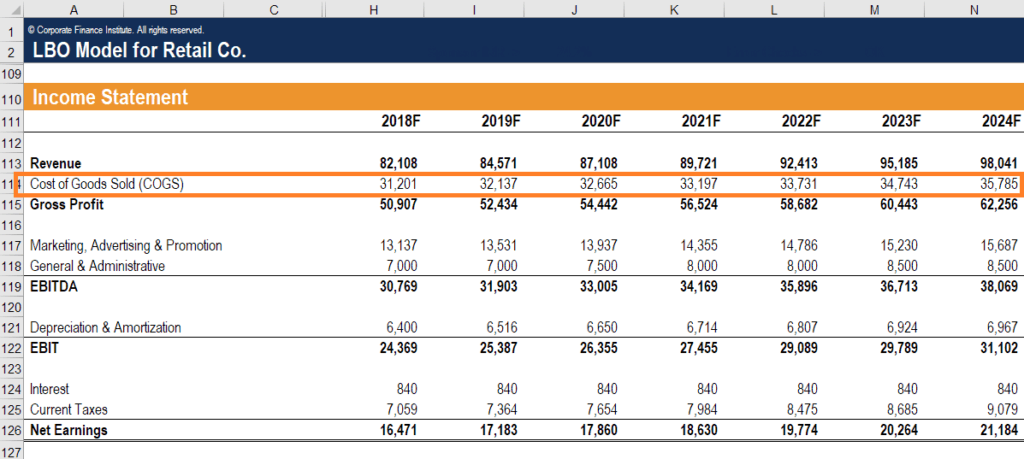

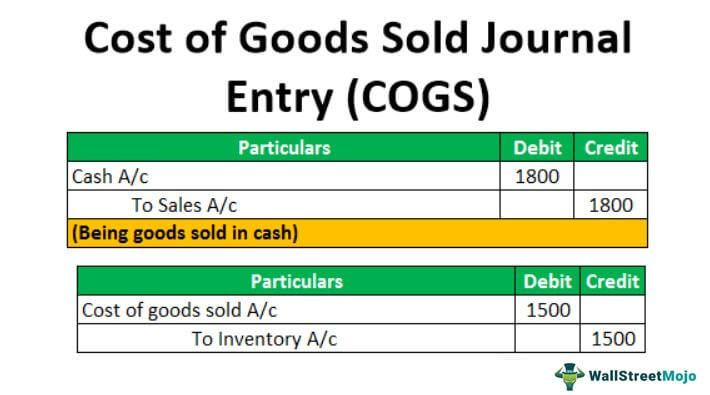

Thus, only the cost of the products that have been successfully sold is taken into account. It’s necessary to stress the fact that the cost of goods sold doesn’t include the expenses sustained to make the products that have not yet been sold. Manufacturing overhead is part of COGS, though. It should be mentioned once again that the cost of goods sold includes only the direct costs paid by a business to produce the goods or services that were sold during the period while excluding indirect costs like overhead, sales and marketing. In the process of product or service creation all companies incur certain costs like material, labor, building rentals and utilities which make up some part of the final price of a product. Based on that, businesses try to keep their COGS low and their net income high. Increasing COGS means decreasing net income which is beneficial for income tax purposes but means less profit for the shareholders. The formula for gross margin calculation is: Gross Margin=Net Sales− Cost of Goods SoldĬOGS is an essential component of determining two critical business metrics: a company’s gross profit and gross margin.ĬOGS is included in business expenses on the income statement. Gross margin is the amount of money a company keeps after incurring the direct costs needed for creating the goods it sells and the services it provides. Let’s leave the formula for gross profit calculation here: Gross profit=Revenue-Cost of Goods SoldĬOGS is also a key component in determining a company’s gross margin, which is calculated by subtracting COGS from a company’s net sales. Gross profit is a key indicator of a company’s profitability which measures how effectively a company uses its resources while producing goods or services. The importance of COGS is explained by its direct connection to the gross profit of the company, which is calculated by subtracting COGS from a company’s revenues. How does COGS work? Why is COGS important?

GAAP provides guidelines about which costs are to be included or excluded in the process of COGS calculation.

Generally Accepted Accounting Principles (GAAP) that requires businesses to apply certain inventory costing principles. Cost of goods sold is sometimes called “ cost of sales.”ĬOGS is also an accounting term under U.S. According to the cost of goods sold definition, this metric includes the cost of the materials and labor directly used to create the product and excludes indirect expenses like distribution and sales force costs.

0 kommentar(er)

0 kommentar(er)